A message from our CEO Richard Hawken

|

|

Dear fellow collectors,

If this year was a qualifying lap, it would be pole! I can’t recall a year that passed so quickly since starting my working life in the mid-1990s. Yes I am older and wiser than I look. So I thought it worth putting pen to paper, or fingers to keyboard and recap this year, as well as look forward to what’s in store for 2024, both at EMM London Private Office and in the wider collector car world.

First, let’s recap what our world as collectable car investors looked like in 2023.

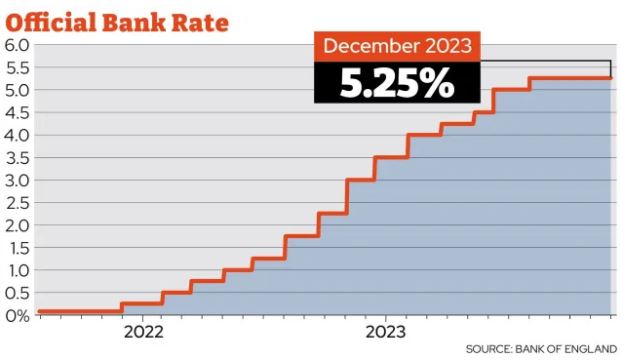

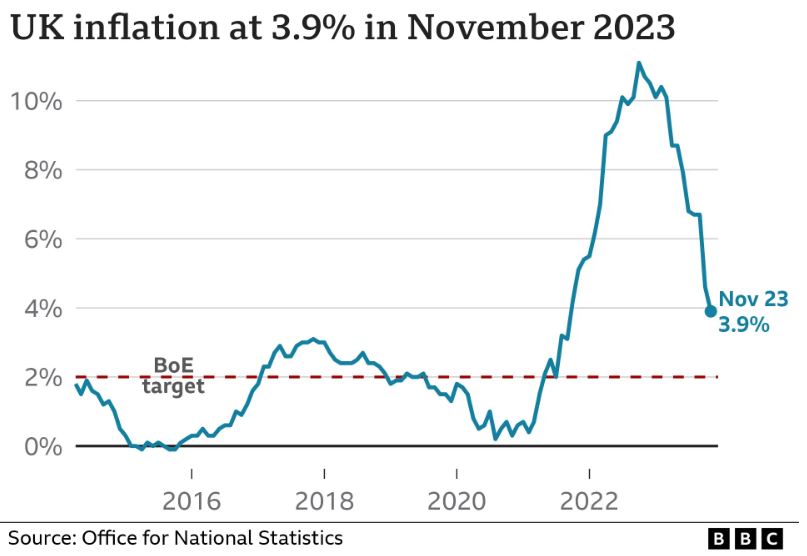

2023 has very much characterised by a year of two-halves, the first part of the year starting off slowly as global inflation was yet to peak, in some cases into double digits (yes that’s you the UK), with the dark and gloomy spectre of interest rate rises and a hard landing ahead of us. This pushed the borrow rate from the majority of car finance houses well into double digits dissuading investors from the benefits of gearing to acquire cars. The projected return on investment when adjusted for inflation (real) started to look much less attractive. Committed collectors however continued to participate, but wisely they prepared to wait and see if a bargain could be had; in some cases they were right to wait. Much of the big demand moved to the discretion of the off-market private offices, such as EMM London. Bad PR seeing a CEO turning up in a newly acquired multi-million GBP classic car during a cost of living crisis. Perception will always be reality in this case.

|

|

|

Even by Easter, values of the best blue chip collectable cars hadn’t responded to the downward global macroeconomic pressures, with no real bargains available. A different story in the small cap affordable classics space (<£150k) where we saw some absolute bargains relative to the values seen at the peaks of 2022 as demand and prices fell rapidly, in some cases as much as 60%. Some of that can be attributable to the froth coming off the market driven by the emergence of online auctions in the post pandemic world. Fortunately, we are now back to kicking the tyres buying and we at EMM London Private Office have never been busier.

The latter part of the second half of the year started to show encouraging signs that global inflation was starting to come under control, perhaps even as a result of the rudderless central bank policy we witnessed. Despite them saying they’re keeping all options open, to me (as an ex-banker), it looked like central bank policy makers had forgotten about the trickle-down effect that takes c18 months from announcement to impacting the street. As the first of the rate hikes had little or no impact, they hit the brakes harder which was only ever going to lead to one thing – uniform overtightening of central bank policy, a hit to growth and an eventual reversal of rates, as I am forecasting for 2024. Maybe not back to the lows of 0.25%, but to a more consumer palatable low-single digit. Personally, I see rates at c2.5% for the Bank of England and ECB by the start of 2025. Question is, who will cut first?

|

|

The trend this year has unquestionably been to invest in the cars of the 80s, 90s and early 2000s at the expense of some stalwarts of the classic car world, such as the venerable Jaguar E-Type. 2023 saw E-Type values falling heavily with many good cars being offered, and not selling at auctions. This is largely attributable to the “nostalgia effect” shifting to 80s and 90s as Gen-X (born 1965 to 1980) reach the peaks of their earnings potential whilst finding their dependents, less dependent post school and university. As we know it's a highly cyclical market, but for now this new trend has come at the expense of cars from the 50s and 60s. That said, a good 300SL or DB5 will always find a good home, but at what price is the key question.

|

|

So all these macroeconomic pressures have temporarily squeezed some of the life out of the collector car market, in some cases quite dramatically. 2023 will be seen in aggregate as a correction year in our world – some say long overdue. 2022 was characterised by the whopping sale of the Mercedes-Benz 300SL Uhlenhaut which sold for $142.9m at a private auction. This is likely to remain a high watermark for the most expensive car sold ever for some time.

|

|

Looking forward to 2024, to us suggests it could/should be the start of a new collector car cycle which means there may be a very small window of opportunity to buy up some cheap cars as we look to a U shaped recovery. My personal view is that we will have the first of our rate cuts in the UK as early as the end of Q1/ early Q2, just in time for the sun to come out and the driving season to start. Lowering rates will stimulate the markets (futures market is positioned already) physically and mentally – borrowing costs fall, yields on cash deposits will look unattractive and the wider securities markets will overheat again. Bring in the passion alternatives.

Speaking to various parties involved with investment grade collector cars has all but confirmed the start of this new trend and seemingly Q3/Q4 2023 has been a turning point. We have been advising buy side collectors and investors to be brave, bid low and try their luck. On the sell side, to be realistic with current values, or rideout the storm. We have assisted several noteworthy collector/investors secure some fantastic machinery in Q3/Q4 of 2023, at quite enviable prices too.

Only monkeys pick bottoms…apparently, but looks like I just picked one.

Part of the squeeze felt by sellers is being driven by manufacturers desperate to deliver new models to loyal VIP customers. Dare ask to delay the purchase of your new Porsche or Ferrari and you’ll be instantly demoted to the bottom of the list at best, or cast completely at worst – believe me, this is happening. So collectors would rather dispose of a prized asset to raise the liquidity for the new model than disappoint the relationship with the manufacturer. This loyalty is however a one-way valve. In a proper downturn, they [manufacturers] will need you, more than you will need them.

|

|

OK so 2024; let’s say inflation settles, rates start to fall, money supply eases and consumer confidence starts to notch higher. What do we buy?

Quite simply, buy what you love, buy your poster car, the car dad had, whatever it may be that makes you keep going out to the garage, or looking behind you when leaving your loved one in a car park. First rule from us when investing in cars is, buy what you love first, and ensure it makes financial sense second.

Sentiment aside, I would take profits in 288, F40, F50 and Enzo and invest wisely elsewhere. We’ve seen the highs short term and the opportunity cost is too great. The best of these cars will always command high prices and always find a home, but if investment is your key driver, they’ve reached their fair value prices for now.

In no particular order my top 5 picks for 2024.

Jaguar XJ220 – I know, I am a stopped clock, but even that is right twice a day. I predict $1m in 2024, £1m in 2025. Huge arbitrage between LHD and RHD despite less RHD models. Most under-appreciated supercar ever.

Porsche 993 GT2 or Turbo S, LHD best to buy and should be able to buy a good, low mileage one for under £1m.

Ferrari 812 Superfast – they won’t get any cheaper and when no more V12 Ferraris are made, good ones will double.

Porsche 997 GT3 RS 4.0 – rare and very collectable, but savvy owners are commanding huge prices for them.

Ferrari F430 - low mileage manuals – Spiders definitely and 16M without a doubt…if you can find one.

I would also look favourably at a 458 Speciale, especially the Aperta, a good cared for 360 Challenge Stradale, anything that raced group B rallying in the 80s, Lancias, Sport Quattro for example, plus also keep an eye on Diablos and nice manual 355 Spiders unless they have the slightly less desirable blue or black leather. Opportunistically keep an eye on ultra-rare pieces like Testarossa Spiders or 512 TR Spiders that command hefty sums at auctions despite not being factory built.

Contact me for more info on these ideas

|

|

|

Collections Management

|

|

As a private office, 2023 for EMM London was the busiest ever since launch in 2019, and we expect this continue into 2024. We are currently working exclusively with a number of medium/large collectors who for varying reasons are looking to consolidate their investment collections. Some of the cars that could be available to collectors are delivery mileage, single ownership examples.

If not already a client of EMM London, and you’re searching for something specific, please contact us to discuss.

|

|

|

EMM London’s Supercar Transporter

|

|

In 2024 EMM London will launch the first of a small fleet of bespoke, climate-controlled single car luxury covered car transporters and associated white glove service.

Having been OCD designed from the ground up by us, we have engineered out 99.99% of the risks and issues of transporting a high value classic or supercar. Our tri-axle air-supension vehicles are rated at 6000kg, easy to manoevre around the tight streets of central London, have the lowest load angle of any trailer or transporter thanks to the adjustable air supension, are hermetically sealed inside with a sophisticated climate-control unit managing the environment at a super-safe 50-55% relative humidity and are tracked the entire time.

With internal dimensions boasting 2.35m width by 5.5m length and a payload of 2.1 tons, we can carry the widest and longest of supercars. We expect the first transporter to hit the road in January 2024 and would be an honour to transport your car.

|

| |

|

Just leaves me to thank you for being a part of our journey this year and to wish you all a very Happy Christmas, or Season’s Greetings with my very best wishes for 2024.

|

| |

|

Copyright (C) 2023 EMM London. All rights reserved.

Our mailing address is:

EMM London 4 Old Park Lane Mayfair London, W1K 1QW United Kingdom

|

|

|

|

|

|

|

|

|

|

|