Latest News

EMM London H1 2020 Review

A rush to the driving seat when the music stops

Welcome to the EMM London’s H1 review for 2020. Most importantly we hope that you have all remained fit and healthy during this unprecedented time we’re sharing so universally. A massive amount of respect and admiration is due for the staff of our UK NHS. So EMM London in partnership with the Goodwood Circuit will be hosting an event to raise donations for the NHS in August called Rolling to Le Mans ’66. Details will be available soon but if you own a Rolls-Royce built between 1906 and 2020, might be worth sticking the evening of 22nd August in the diary for something quite special.

From now on we will return to a quarterly news publication, but if you’d rather not receive our news updates on the collector car market, please unsubscribe HERE

Introduction

For those new to EMM London, we are a passionate, discreet, luxury automotive private office for avid car collectors. Our team of London based collector car specialists are built by design from an investment banking, fund management and professional motorsport background; set up by collectors, for collectors. The company was launched to address the endless demands of classic and super car owners requiring specialist automotive services for their often highly enviable collections. Despite the name “EMM London”, our clients span the globe. Our key differentiator is not only our OCD level approach towards how we treat clients and their cars, but also aggregating 24 different services, all under one roof. To learn more please follow this link to the ABOUT US section of our website or www.emm.london

2020, what the hell happened?

As the world gradually starts to unwind the lockdown through a lowering of the infectiousness rates or because we’ve pushed global economies to the brink of financial Armageddon, it’s worth reflecting on how this has, if at all impacted the somewhat financially galvanised collector car market. You might find the results surprising, we did.

The COVID-19 Coronavirus and the globally imposed lockdown saw many predicting the collapse of the classic and collector car market. Nobody could travel, dealers were shut and car auctions at best were postponed, most being cancelled all together. In January 2020 the EMM London team predicted the year would mark the bottom of the prior cycle and the start of another supported by the encouraging signs of a recovery of the sell through rates from the early year US auctions. But nobody can predict the impact of an exogenous event like COVID-19. The market peaked in late 2015 and has slowly been rotating through the cycle ever since. Like traditional markets, cars move in 4-5 year cyclical economic rotations, so we monitor it quite closely.

A toxic combination of a Russia/Saudi oil price war that squeezed the oil price to -$37 (yes the market was paying you $37 to buy a barrel of oil at expiry), a momentous crash in global Equities and the rapid escalation to enforced global lockdown levels led to a virtual freezing of the entire world, economically and politically. Given how the global pandemic totally dominated the news around the world, some don’t even know there was an enormous and arguably inevitable stock market crash in March this year! In the financial world, this period will be remembered as the greatest post 1929 crash on record.

So how does this to compare to 2008 and importantly, the collector car world?

There was a notable correlation between macroeconomics and collector cars back then, very similarly to what we are seeing now. UK interest rates at the close of 2008 stood at 5.5%, falling to 2.0% by the end of 2009. This correlated with upward moves in collector car prices and volumes sold. The following decade [in collector cars] produced tax-free returns of over 300% according to Knight Frank’s Luxury report, outperforming every other market. In fact, for almost four decades, the collector car market had been motoring higher. From 1980 to 2018, classic cars were by far the best-performing collectable asset class, according to the Credit Suisse “Global Investment Returns Yearbook 2018” (that’s when the highly respected annual report last looked at alternative investments). In that time, the value of the classic car market, as measured by the benchmark Historic Automobile Group International (HAGI) Top index, grew by a staggering 242 times.

Working on a trading floor in the City of London’s financial district back then I witnessed the financial world around me metaphorically burn to the ground. Seeing the DOW, S&P, DAX and FTSE limit down at the open was a memory that will live with me forever. Conversely though, the value of my classic car collection didn’t wobble; in fact, as well as competing in motorsport, I was busy sourcing exotic cars in my spare time for a network of wealthy clients I had built up who share my passion for collecting rare and exotic cars. They were busy bargain hunting, whilst all those around them were losing their shirts. Even with UK interest rates at 5.5% (end 2008) savvy investors deployed capital into collector cars from the cash they had raised from selling the traditional markets. To recall, the statistics (we use the K500) confidently shows capital flowed into the collector car sector in the aftermath of 2008, largely due to the safe-haven status of them being negatively correlated to tradtional investment markets, in particular our bellwether, the S&P500.

Similarly, at the start of 2020 UK interest rates stood at 0.75% falling to 0.1% by 19th March 2020, the lowest on record. At the time of going to press, rumours are circulating that the UK could see negative interest rates this year to stimulate life back into the economy. Let’s face it, there’s not much point in keeping it on deposit at these rates, so the prospect of owning a classic or collectable car beckons those chasing alpha. But after a meteoric rise, certain cars can afford or need a correction, if only to attract a new breed of younger enthusiast who perhaps don’t see them currently worth the multi-million price tag. There’s no denying the beauty of a 1960s Ferrari though, so as we move to automated clones on wheels, a rawcus V12 with no roof or mandatory safety aids, styled by Pininfarina will always be an attractive asset, but its ultimate attraction remains simply a function of price.

Economic insecurity and inaffordability has driven certain investors to seek alpha in better valued assets. We welcome back with open arms the ‘affordable classics’ market, but like every revisited trend, it cycles with a subtle difference.

For the purpose of definition, we refer to cars a bit like we do stocks :

£10k to £200k

£200k to £1m

£1m to £25m

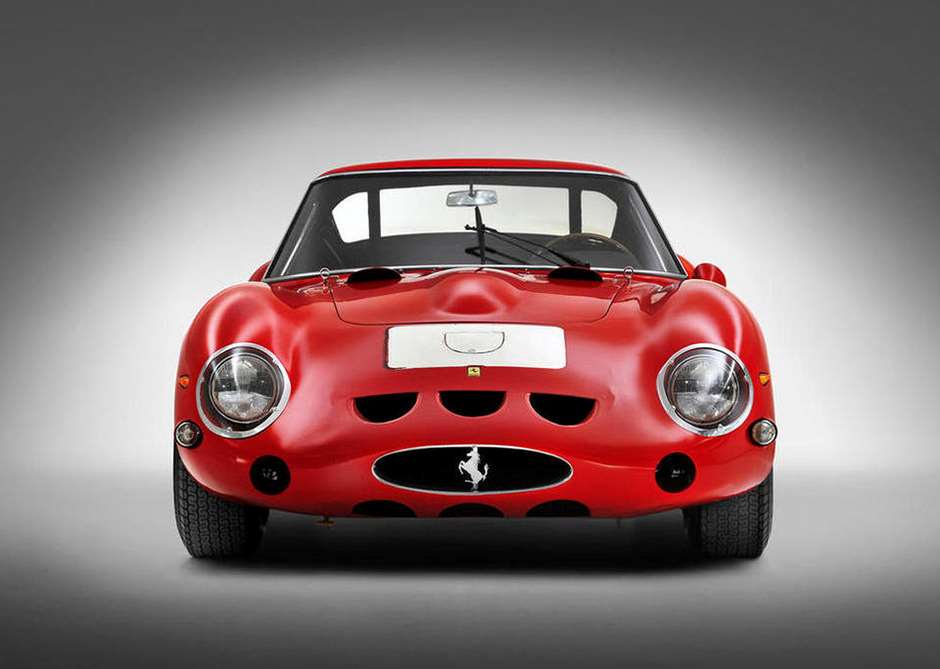

£25m and above, reserved for the Ferrari 250GTO, 250LM, 250 TR etc

We keep a very close eye on both the supply and demand cycles remaining in constant and regular contact with around 200 people spanning buying/selling clients, auction houses, lawyers, dealers, publishers, detailers and transport teams. This gives us a 360-degree view of the market on which we are able to make projections and forecasts for and on behalf of our clients.

In a nutshell, our research from the last 3 months leads us to conclude the following, during a somewhat turbulent H1 2020:-

sector is outperforming markedly well across most geographies, fuelled by an almost seamless switch to online auction sales, cheap money and probably mass boredom.

sector is also showing a very strong 3 months as the major auction houses went virtual with many buyers taking the plunge and buying their dream cars.

sector is at best stable, but transactions are taking a long time to complete as buyers get educated that prices are very unlikely to fall any further, if at all.

sector remains stable, but still highly illiquid. As the wealth effect widens, we can’t foresee a scenario where this sector will suffer. Recession proof investments.

EMM London has a network of clients that spans the world, from many different religions and currencies, but their approach to their car collections is fairly united in so much as they are chasing the same quality/price ratio in what is a very narrow market. We have maintained contact with most throughout the crisis as they each dealt with the varying degrees of impact on their respective car collections. Fortunately, 2008 was only just over a decade ago with most remembering the positive impact the period had on car values. Like before, they all want to buy a bargain. “can you find a bargain Ferrari…..” filled our CRM, the psychological FOMO (fear of missing out) spiked demand not just for the top of the market, but all price ranges. The reality of it though is prices in the mid and large caps again as in 2008 haven’t blinked. The real wealth is somewhat galvanised from markets in either direction and let’s face it, even if geared, they don’t need to sell, particularly under the market price. These collectors aren’t going to give their cars away because of some cancellations of a few social events. Their cars are still worth plenty of money, and they are going to get a price that is justified if they do decide to sell. We believe most will just simply not do anything. So at the top of the market we would conclude there are no real bargains to be had currently. Will that change, we are very doubtful it will.

AFFORDABLE CLASSICS “We’re back”

Recent online auctions have increased sales to peak levels

One of Warren Buffet’s best pieces of advice is to “be greedy when people are fearful, and fearful when people are greedy”. Now combine that thought with the psychological condition known as FOMO or Fear Of Missing Out and being locked in your house 23 hours a day 7 days a week with easy access to literally thousands of alluring cars via the internet and you start to build the demand side of the argument. Ultra-low interest rates, spirit crushing boredom, a desire to be busy again, nationalised salaries, 0% loans and the necessity of a project to get out of the house, has encouraged first-time collector car buyers to dip their toes into the collector car water. In the mid to large-cap space we are seeing new entrants buy up the childhood dream car, a Ferrari F40 or Porsche 959 for example for pre-crisis prices, or even the car they had when they were 17, an Austin Allegro perhaps. There’s an undeniable emotional attachment to the times and the events of our motoring youth, much more so than the products we actually drove around in. But to rekindle those times, the sound, the smell the laughs and the memories is enough to open most wallets in such alternatively depressing times.

The internet has undeniably accelerated the ability to buy cars over the last decade, but not as much as in the last 4 months. Many of the big auction houses had already been preparing their revised online websites – the smart ones used the early times of lockdown to roll out their new platforms to users as an alternative way of buying a car. The great thing with the internet is you don’t need to travel 3000 miles, rely on good weather or travel to a remote auction location. That said, it’s a passion fueled social event we will all miss greatly this year. Despite what people think, live bidders are actually not what auctions rely on, it’s the hush-hush deals by private buyers, international callers, and purchasing agents that drive sales according to David Gooding of Gooding & Co so the transition to online for some has been quite seamless. EMM London’s team has vast experience in handling sales and purchases of collector cars for and on behalf of our clients. Please contact us HERE to learn more.

Whilst managing social distancing, thousands of cars have been listed and sold for good prices at online auctions, with peak of the cycle sell through rates achieved in some cases recently as highlighted below. RM Sotheby’s reported that a recent auction attracted over 900 different bidders (up 23% YOY) from 44 countries bidding for a lot of just 68 cars. It’s unlikely even a quarter of those would have travelled to a live auction. Having no other choice but online appears to have exacerbated an already imminent move to increasing the internet auction offering. And it’s not just small and mid-cap cars selling well online either. In May RM Sotheby’s sold a 2003 Ferrari Enzo for £2.14m without the buyer even seeing the car. This is as of the date of this publication the most valuable car to sell via an online-only auction.

| Auction | Sell through rate |

| 5 February 2020 Retromobile RM Sotheby’s | 79% |

| 20-28 March 2020 Palm Beach | 71% |

| 21-29 May 2020 Palm Springs (online) | 60% |

| 3-14-11 June 2020 RM Sotheby’s European Sale (online) | 91% |

But buying blind might seem a bit risky to some, so a few auctions such as Silverstone offered ‘by appointment’ only viewings whilst maintaining strict social distancing measures, or specialist inspections were carried out which can be done by a single person. EMM London offers 3 different levels of inspection for those wishing to get a report on a car prior to bidding including a highly detailed walkaround video. These can normally be booked with just 24 hours notice. Please contact us HERE to enquire.

Interestingly Randy Nonneberg founder of US weekly auction site (BAT) Bring A Trailer reported in mid-April that they had seen the most traffic ever to their site and that 80% of their busiest days were in the month of April and May. Through Spring, BAT normally has a sell-through rate of 70%. In the first week of April 2020, they saw an impressive 95% sell-through rate.

The Market, who I personally used to sell one of my classic Rolls-Royces, reported a tripling in site traffic and over 90% sales success rate on their online auction site, thanks largely to the quality of the detailed descriptions and the encouragement to post up to 200 pictures of the listed car.

Rolls-Royce Silver Shadow sold via The Market

Car & Classic reports online visitors are spending on average 5% more time browsing classic cars adverts.

At first glance of the data to prepare this blog we thought April was a one-off, a lucky dealer or auctioneer with the right amount of stock, but then everyone we spoke with reported the same set of stellar results through both May and June. Some even reported the busiest most profitable periods in their living memories. Independent specialist dealer Ashgood Porsche sold 90 cars in the last 3 months, classic car lifestyle specialists Duke of London couldn’t believe the result of May 2020 selling over 30 cars of their own. This was supported by independent dealers we spoke to for Ferrari, Rolls-Royce, Porsche and Aston-Martin; all reporting record used and classic sales during lockdown, whilst new cars gather dust at ports – deliveries down 57% YOY. And it’s not just the UK, our friends at Rosso Corsa in Marbella that specialise in just Ferrari tell us “sales during lockdown were good, but as soon as we could reopen, we sold a lot of cars without much effort at normal prices”. Specialist large-cap supercar dealers Amian Cars in Germany report “sales were not too bad, good even, we expected much less”. Even our specialist London based collector car lawyer reported what has been possibly the busiest period of his career. And to support all this trying to get our contracted network of car transporters to deliver a car was virtually impossible; they were far too busy, booked up to a month in advance.

Perhaps this increase in sales has been catalysed by not being able to take a holiday, avoiding public transport, or the constant yearning to get out and drive again as we can report track days such as with RMA are totally oversubscribed. Or is it just the need to meet like-minded friends, albeit 1-2 metres apart? Perhaps frustration levels have peaked at the cancellation of motoring events such as Goodwood’s Festival of Speed or the famous Revival. Is it perhaps the lure of interest free short-term bounce-back continuation loans which can be used as the deposit on a new car purchase then repaid at just 2.5%, or perhaps even people identifying that a healthy life can’t be taken for granted anymore – there may not be another chance like this. It could even be just a plain psychological simple motto to “live for the day” or “just do it” as Nike would say when pondering that car purchase. Whatever the catalyst, it has produced results that have surprised many. Raises a question though, what happens when the interest free period ends in 12 months’ time, do we see these cars for sale or do they keep them and pay the loan back? Is that the sound of a bubble I hear inflating?

There is light at the end of what has been a dark, lonely tunnel though as the London Concours (19-20 August, HAC, London) looks to be the first major classic car event in the UK. EMM London are proud to be a part of the exclusive concours judging panel this year.

London Concours event at the HAC 19/20 August 2020

So whatever happens in Q3 and Q4 remains to be seen now we are starting to relax the enforced lockdowns. The depth of the economic impact and the speed of its recovery could be influential to the health of the classic car market; I say influential as who would have predicted the results of the last 4 months? Cars are tangible, easily purchased assets that give pleasure to the owner and could make attractive investment purchases to someone who has reassessed their priorities during the pandemic. But collector cars are still luxuries, and it will only take a small amount of reduced buyer demand coupled with panicking sellers, desperate for cash, to upset the strangely positive results we’ve seen over the last quarter or so. Personally, I am expecting a more ‘V’ than ‘U’ shaped recovery in global economies so if the worst were to happen, I’d be fairly confident there will be buyers ready to pounce. Watch carefully though, the spectre of inflation looms if we do V shape, which could then encourage central banks to apply the brakes with interest rate hikes. But I think we are still a fair time away from the that as a scenario and if you have a government backed loan at 2.5%, you’re laughing.

In conclusion, our data suggests there is currently no correlation between classic car sales and monetary desperation or hard times at any level, that’s not saying it isn’t there, just we haven’t found any evidence to counter our assumptions. The recent wave of buying whilst surprising has been driven by many differing human factors – fear of missing out, lure of cheap loans, boredom, frustration and distraction but they’ve all resulted in the same conclusion – buy a collectable car.

We continue to advise our clients on a daily basis to be diligent and detailed, do your homework, seek the car you desire and find the best example possible. Use professionals (like EMM London) if possible to find the right car. Investing in passion assets has never been about luck, but if you keep watching, waiting for the right moment, you’ll miss it as this and prior periods have taught us. in 2008 a Ferrari F50 cost around £450,000. The same car in 2017 sold for £2.56m an ROI of 469% in 12 years, or 15% PA. Might just be worth remembering Mr Buffet’s advice.

Stay healthy.

Richard Hawken

Founder/CEO